In order to be totally compliant with your state in regards to the SR-22 certificate, the issuing business of the certificate need to be certified within the specific state. Not every insurance policy company is able to issue the certificate, so it's crucial to discover the company that is able to do so legally to make sure that you're able to get the certificate, have it reported to the DMV and afterwards continue to be able to drive on your license without concern of being in violation of any type of laws.

Get in touch with your present service provider first and afterwards opt for a business who is cost effective as well as licensed within the state. insurance. The DMV in addition to the courts will have the ability to provide you with particular documents as to where you can get the SR-22 in order to continue to be certified. On top of that, it's needed to recognize that obtaining the SR-22 has to consist of contacting your current insurance policy carrier concerning the certificate.

This will make sure that you have followed the appropriate treatments and can not be located in infraction of anything. If you were insured at the time you were needed to have an SR-22, the insurer you were with may cancel your plan with them, depending on your state legislations as well as the specific insurer you were with (e.

especially real if they do not use SR22 insurance). Submitting an SR-22 Policy When you get the certificate, you will certainly after that have the ability to get the proper plan based upon what the regards to the certificate are. At this factor, it will certainly be sent to the DMV to remove the suspension off your license.

The Basic Principles Of Illinois Sr-22 Certificate, High Risk Driver Insurance

The plan in impact with the certification need to meet all minimal responsibility requirements with the state. Every state has their very own liability demands, so it will certainly differ considerably based upon the regulations of your individual state.

Most states in the nation report suspensions as well as other concerns on a nationwide computer system. The DMV of the majority of states for that reason can not issue a permit if you have actually been put on hold in another state without very first obtaining the SR-22 as well as having it reported to the DMV (insure). This makes sure that your driving benefits are suspended up until you can show monetary obligation.

Certain costs may be examined in conjunction with creating the SR-22 certification. This is in enhancement to any court costs as well as the extra cost of SR22 vehicle insurance.

Equally as you can have a chauffeur's permit without being an auto owner, the exact same holds true of an insurance coverage. In most cases, despite whether you were an auto proprietor at the time of the event or otherwise, getting a non-owner SR-22 may be the only manner in which you will certainly have the ability to renew your driving privileges if your license was suspended.

Various Kinds of the SR-22 There are typically 3 kinds of the SR-22 that can be issued by a certain state. It is consequently essential to get the appropriate type after having actually been provided an SR-22 form: This sort of policy will cover the driver in the procedure of any lorry, also if not owned by the chauffeur.

The Comprehensive Guide On Sr22 - Sr22insurance.net Fundamentals Explained

This type of plan covers all cars owned by the chauffeur. The lorry needs to either be noted on the SR-22 or be issued as "all possessed cars" in order to be certified. This kind of certification covers all lorries had or un-owned by the driver and is as a result one of the most comprehensive of the 3 kinds of SR-22 certificates.

One of the most usual certification is the Operators-Owners Certificate due to the fact that it makes sure that you are covered no issue what kind of automobile you are driving (sr-22 insurance). This is also typically the one to have if you drive a company vehicle at any offered time, or might ever before locate yourself behind the wheel of a cars and truck that is not possessed by you.

If you are ever drawn over and can not supply the ideal documents as a result of the means your SR-22 certification is worded, you can have your certificate put on hold once more and also have actually legal process filed against you for failure to stay within State regulations. Relocating Out-of-State Needs If you ought to vacate the state where your web traffic offense is as well as where your SR-22 has actually been issued, you have to speak to the DMV office of your brand-new state in order to ensure that you are in accordance with new state regulation - insurance group.

A Sworn statement is most frequently required in order to obtain the waiver. coverage. Some states will certainly need you to do absolutely nothing while others will require that you get a brand-new SR-22 based upon their economic obligation regulations, depending upon whether you lug higher or less than current state levels. The Distinction In Between the SR-22 & the FR-44 SR22 insurance policy is not to be perplexed with FR44 insurance.

The FR-44 is a certificate that is needed in specific cases including alcohol and/or drugs as well as will certainly raise the minimal responsibility demands substantially, therefore making insurance policy typically even much more expensive due to the demand to have the greater than minimum demands - vehicle insurance. You will certainly understand which kind of certificate you are needed to obtain based upon the state that you live in as well as what the judge orders you to get.

The Single Strategy To Use For What Is Sr-22 Insurance And How Much Does It Cost?

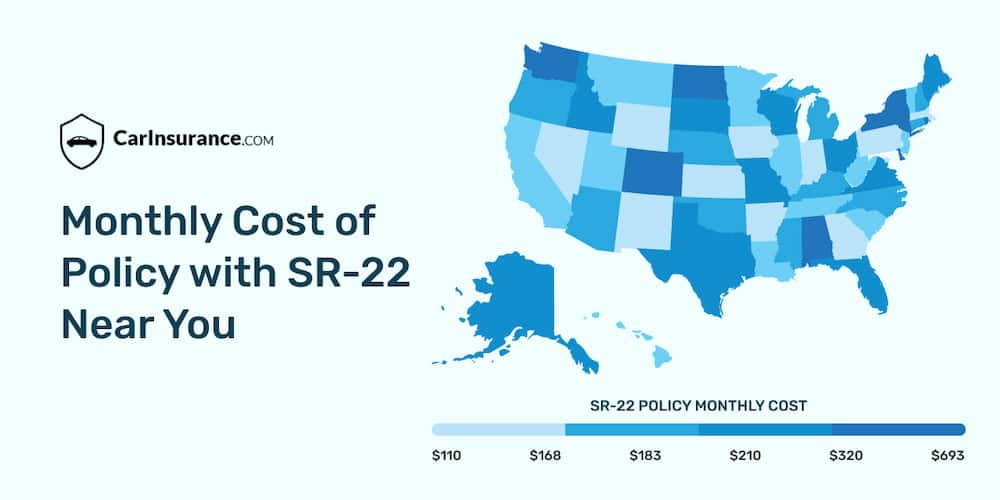

Last Notes The finest way to totally comprehend the details of the SR-22 is to acquaint on your own with state laws. The declaring of the certification will be dealt with in different ways from one state to another. The fine and also filing costs will certainly differ as will certainly with the certificate will in fact be required. Given that all states have various monetary obligation regulations, the SR-22 will certainly look very different in The golden state than it would in Ohio or another state.

Price contrast website, Auto Lending states the cost of obtaining an SR-22, which is between $15 and also $30, much surpasses the financial and also lawful risks of not lugging one which can be thousands. Numerous SR22 insurer will certainly deal with you to overcome the problems that you have actually had to sustain - department of motor vehicles.

Ever before wonder what is an Sr22? While Sr-22 insurance coverage isn't necessarily a kind of insurance policy individuals want by option, it is a requirement by most states to show that a particular individual has a specific degree of automobile insurance policy - driver's license. Typically, it is needed by a court or court after an individual has a crash or gets a DUI as well as does not have the bare minimum of lawfully required insurance coverage at the time.

What is Sr22 Car Insurance Coverage? Some insurance carriers do describe their SR-22 automobile insurance coverage prepares as "high danger insurance policy" for chauffeurs who have had severe crashes with victims or a history of driving drunk. Sr22 insurance coverage manage the truth that the party getting it is a high threat client and commonly deals with confirming to the state that they are currently correctly guaranteed and also able to get on with driving again.

Not to seem judgmental however after such behavior, your status as an SR-22 auto insurance policy customer suggests you are rather a lot an unfavorable aspect with many insurance policy service providers. Not all insurance companies will cover SR-22 insurance policy customers. underinsured. What Sr22 Insurance Coverage Does Now, every person should have a second opportunity to redeem himself or herself and also getting SR-22 insurance protection is the very first step in the direction of doing that in the eyes of your provider as well as the legislation.

Everything about Missouri Sr-22 Insurance Questions

Is Sr22 Insurance Policy Forever? After a couple of years of no accidents or various other serious driving offenses, many people will no much longer need to submit SR-22 kinds to their state to verify that they are guaranteed and will certainly no more have to pay the greater costs that are typically connected with Sr22 insurance policy coverage (liability insurance).

Do not consider the restrictive nature of SR-22 auto insurance policy protection as something you will certainly have to deal with forever. Contending least some type of responsibility vehicle insurance coverage is called for by the majority of states as well as if you have actually been associated with some kind of mishap of incident where you really did not have any car insurance coverage, you will need to check into acquiring SR-22 auto insurance policy coverage due to the fact that it will instantly submit a type with your state confirming that you are covered.

This is, obviously, really significant and not something that must be overlooked. Driving is an advantage and also not a right and component of having that advantage entails being appropriately guaranteed. Buying SR-22 automobile insurance policy will certainly insure that you will be able to appreciate that privilege for several years ahead whatever has actually occurred in the past - department of motor vehicles.

An SR22 filing is not insurance policy. It's a form that your insurance policy company uses to confirm to the government that they will insure you approximately the legally required minimal quantities. According to The Balance, courts don't buy every ticketed driver to safeguard an SR22. Regulations usually differ by state.

Also if you don't possess an auto, after the judge sentences you for a major relocating offense such as careless driving or a DUI, the majority of states still need you to submit an SR22. If you do not intend on driving till the state lifts its provision, you may be able to drop your coverage. coverage.

The Basic Principles Of Everything You Need To Know About The Sr-22 - Usaa

These specialists can help you select the appropriate coverage based on your scenario. A nonowners plan additionally has details standards, such as: You can not own a car.

This kind of SR22 insurance coverage plan is not going to obtain you road legal. It will obtain you in excellent standing with the state and give you protection if you're ever before in a crash. For instance: You borrow your close friend Steve's automobile, and you trigger a severe mishap. Steve just has the state's minimum obligation coverage on the lorry, and the problems surpass those limitations.

Remember, never ever let a car insurance policy with an SR22 filing expire. This habit is constantly a negative concept since your insurer is obligated to notify the state when it terminates your plan. This activity will likely cause a suspended driver's permit. If you allow this to take place, you might have to reboot your probationary driving standing over once again.

FOR HOW LONG IS AN SR-22 VALID? Each state has its very own requirements for the size of time that an SR-22 must remain in area. As long as you pay the needed premium and to maintain your plan energetic, the SR-22 will certainly stay in effect till the demands for your state have actually been fulfilled (sr-22).

WHAT IS THE DIFFERENCE IN BETWEEN AN SR-22 AND AN FR-44? In the states of Florida and also Virginia, an FR-44 is a "Certification of Financial Obligation". It resembles an SR-22, but an FR-44 generally calls for higher responsibility limitations. EXIST ANY FEES FOR DECLARING AN SR-22? Many states need a little filing cost when an SR-22 is very first submitted.

The Main Principles Of Sr-22 In Texas - Bankrate

At Safe, Auto, we comprehend that looking for automobile insurance protection can be stressful as well as costly - department of motor vehicles. You can call a dedicated Safe, Car consumer solution agent at 1-800-SAFEAUTO (1-800-723-3288) to request an SR-22 be filed.