Here are some approved installation centers: Life, Safer Interlock Intoxalock Do not remove the mounted gadget prior to your suspension duration as it will require you to start the suspension over again - sr-22.

An SR-22 is not a real "type" of insurance policy, but a kind submitted with your state. This type serves as proof your vehicle insurance coverage policy fulfills the minimum liability insurance coverage required by state legislation.

Do I require an SR-22/ FR-44? Not everybody requires an SR-22/ FR-44. Laws differ from one state to another. Generally, it is required by the court or mandated by the state only for specific driving-related infractions. : DUI sentences Negligent driving Crashes created by uninsured drivers If you need an SR-22/ FR-44, the courts or your state Electric motor Automobile Department will notify you.

Is there a fee associated with an SR-22/ FR-44? This is an one-time cost you should pay when we file the SR-22/ FR-44. coverage.

A filing fee is charged for each and every private SR-22/ FR-44 we file. If your partner is on your policy as well as both of you need an SR-22/ FR-44, after that the filing charge will certainly be charged twice. Please note: The charge is not included in the rate quote due to the fact that the filing charge can vary.

How much time is the SR-22/ FR-44 legitimate? Your SR-22/ FR-44 should stand as long as your insurance plan is energetic. If your insurance plan is canceled while you're still required to lug an SR-22/ FR-44, we are called for to inform the correct state authorities. If you don't preserve continual protection you can lose your driving advantages.

Not known Details About Sr-22 Insurance: What It Is And How To Get Cheap Quotes

Right here are some methods that you can protect against needing SR22 insurance. Don't drink and also drive.

Do not drive without insurance policy. Pay your tickets and fines so that your chauffeurs permit is not withdrawed.

You may even need to participate in traffic institution. This is constantly a far better alternative than having your chauffeurs license eliminated. Prevent careless driving. This could indicate racing, driving illegally, road craze as well as a myriad of other things. You must comply with traffic regulations and also attempt to drive as safely as feasible.

Constantly have you evidence of insurance as well as vehicle registration offered. It is prohibited to not have proof of insurance while driving - insure. Right here are the states that do not require SR22: Even if these states do not require this declaring, you must keep SR22 insurance if you are relocating to a state that requires it.

There is a light at the end of the tunnel. When you make the right selections, apply for SR22 and maintain a good driving record, you will once more get your life back on track. The cost for this filing is typically under $50. This is not the component that will cost you - sr22 coverage.

You will need this insurance coverage for 3 years. Despite the fact that this could cost you extra, ultimately, you will be pleased to understand that your SR22 insurance can be dropped as well as you can advance as a typical vehicle driver. A DUI nevertheless does occupy to ten years to leave your document (insurance group).

The 20-Second Trick For How Much Is Sr-22 Insurance Per Month In Illinois?

You are mosting likely to be extremely delighted. It is constantly good to recognize that SR22 is not like regular car insurance. That is a certificate for Division of Electric Motor Vehicles that you are able to bring normal vehicle insurance policy for your car. Consequently not every auto insurer is able to aid you with SR22.

We see to it that all policies are correctly submitted as well as maintained. One of the most common reason for SR22 insurance policy in The golden state is to reinstate driver's permit. Nowadays a vehicle is a part of our lives. Life can become a problem without having legal capability to drive. Below is a full checklist of reasons for SR22 demand in The golden state: DUI (Driving under the impact of alcohol) DWI (Driving while intoxicated) Caught on driving without auto insurance coverage - sr-22 insurance.

In The golden state SR22 insurance policy is mandated for 3 year period. In case you fall short to preserve your policy you will certainly be needed to start over.

You are probably to obtain this demand for multiple violations. Consequently, the final price will be changed according to your driving history. For instance: Drunk drivings, accidents, claims, and so on. auto insurance. Your age young drivers under age of 25 have higher expenses for insurance costs. Chauffeurs at the age of 55+ will have fairly lower costs.

In other words, married person will most likely get much better rates after that single with very same profile. That is why males will have slightly higher prices on insurance coverage.

Credit Rating poor background with banks can result in greater insurance coverage rates. SR22 is all about the capability to preserve your insurance status throughout needed duration.

Getting My Get Cheap Sr22 Car Insurance - Cheapinsurance.com To Work

However, Select Insurance coverage Group is capable to supply prices also less after that $15/month. This is because of the truth that we shop numerous sources to offer cost effective prices to our consumers. insurance coverage. Pretty typically we have discount programs. The very best method to check if you are qualified is to complete our quote kind.

Once authorized you will certainly get a letter from the DMV stating they have actually gotten your automobile insurance policy with type SR22. Preserve this insurance coverage for a minimum of 3 years or your court-ordered suspension period (sr22 coverage). Do not let this policy gap as your certificate will be put on hold once again as well as the duration will certainly begin again.

If you're in problem in The golden state due to being without insurance in a wreckage or getting a DUI, you might be needed to confirm you have vehicle insurance coverage with a kind called an SR-22 - sr22 insurance. An SR-22 is a certificate, called a California Insurance Policy Evidence Certification, that your insurer files with the California Division of Electric Motor Cars.

See what you might save on cars and truck insurance, Easily contrast individualized rates to see how much switching vehicle insurance policy could conserve you. If you do not obtain an SR-22 after a major offense, you could lose your driving privileges. sr-22. Here's why you might require one and how to find the most affordable insurance rates if you do.

Just how to get an SR-22 in The Golden State, Submitting an SR-22 isn't something you do by yourself. California calls for insurance firms to electronically report insurance coverage information to the DMV.If you need an SR-22, ask your insurance provider to file one on your behalf if it will. Some insurance provider don't file SR-22s - motor vehicle safety.

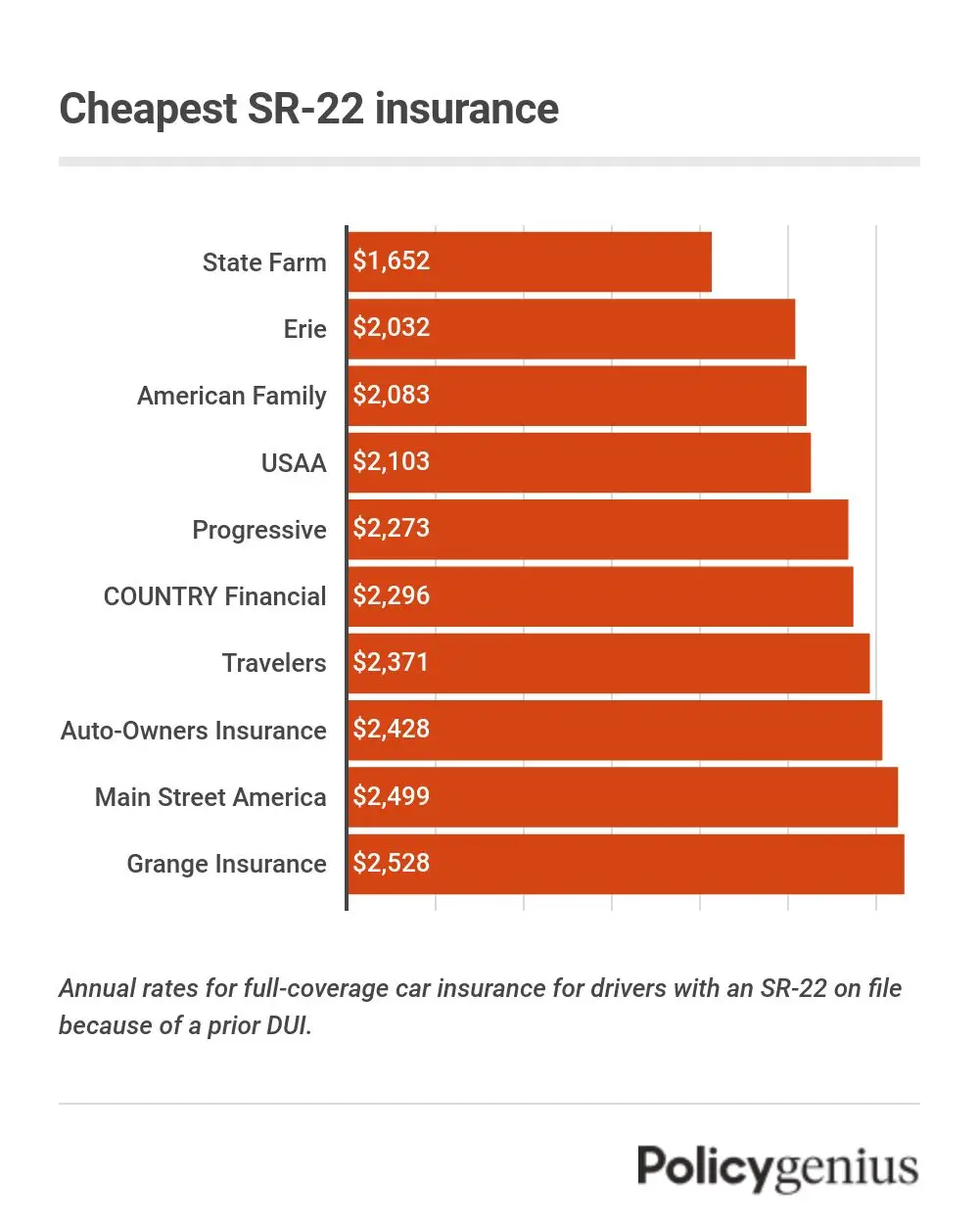

Our analysis discovered that some insurers provide cheaper insurance coverage, so it pays to go shopping around as well as contrast auto insurance policy quotes (division of motor vehicles). Our analysis of the most inexpensive insurance companies after a DUI discovered that: California's 5 cheapest insurance companies increase annual minimum coverage rates an average of $227. Grange Insurance policy Organization returned the least expensive ordinary minimum coverage rate after a DRUNK DRIVING, at $723 a year or $60 a month.National General, which aims to provide budget-friendly insurance for vehicle drivers with one DUI on their documents, had the tiniest increase in typical price out of the team, including simply over $38 to the ordinary minimal rate for vehicle drivers with a DRUNK DRIVING, at $725 a year or $60 a month.

Esurance Car Insurance Quotes & More Can Be Fun For Everyone

Due to the fact that insurance providers make use of various factors to price rates, the cheapest insurance provider before an offense most likely won't be the cheapest after (vehicle insurance). Our evaluation discovered that while Geico had the most affordable average annual price for an excellent driver with minimal insurance coverage, after a DUI the price boosted by more than 150%, pressing the company out of the leading 5 most affordable companies for an SR-22 in The golden state.

Before you begin searching for cheap SR-22 insurance coverage in Georgia, you must recognize that SR-22 insurance policy doesn't really exist. An SR-22 is an order by a court or the state of Georgia to send proof of insurance coverage to the Division of Driver Services (DDS). What is "SR-22 Insurance coverage?

One of the most typical factor policies are rejected is a motorist's document. If your driving document has various events on it, a service provider might or may not select to guarantee you. The ideal national service providers, such as Geico or Progressive, have the ability to guarantee chauffeurs seeking an SR-22.

If you want to keep your permit and proceed driving, you will certainly require to ask your insurance firm to send out an SR-22 to the DDS immediately. If you do not have insurance, you will certainly need to find an insurance coverage business ready to guarantee chauffeurs seeking an SR-22 (sr22).

Upon sentence, a court will get the vehicle driver to pre-pay up to 6 months for minimum liability for 3 years. Like an SR-22 it ensures future insurance coverage, but it is more stringent due to the fact that month-to-month payments are not a choice until three years have actually expired. An FR-44 is additionally comparable to an SR-22 due to the fact that it, too, confirms monetary obligation (for this reason the 'FR').

10 Simple Techniques For Ignition Interlock Device Sr-22 Insurance Costs & Faqs

When this is the situation, chauffeurs are commonly gotten to acquire double the state's minimum obligation requirements. SR-50s resemble SR-22s in that they verify a chauffeur is bring the mandated minimum liability requirements stated by the state. Indiana demands SR-50s when a driver has actually had two relocating infractions within the very same year, an accident record has been filed or chauffeur has a moving offense after a videotaped DWI.

It, too, is not insurance but rather proof of insurance. With an SR-22, the vehicle driver can satisfy any obligations by making regular monthly payments. With an SR-22A, vehicle drivers should pay for insurance coverage 6 months in breakthrough, as well as they need to do so for three years.

(Mon-Fri, 8am 5pm PST) for a of your SR22 Texas, or submit this type: Learn more about. What it is, that needs it, SR22 Texas Insurance coverage prices estimate, companies, contrasts, what it covers, just how it functions, specificities for Texas state, just how to obtain SR22 car insurance policy, renewal and/or expiry and far more.

While this may hold true, there are various as to why an individual could be expected to purchase an SR22. SR-22 a kind of automobile coverage. In truth, it is simply a document asked for with the (Department of Electric Motor Vehicles) that has actually to be filled in as well as licensed by utilizing a qualified automobile insurer.